ohio sales tax exemption form reasons

1 If a vendor seller or consumer is purchasing a motor vehicle a watercraft that is required to be titled or an outboard motor that is required to be titled and is claiming exemption from the sales and use tax based on a reason other than resale the vendor seller or consumer must comply with rule 5703-9-10 or 5703-9-25 of the Administrative Code. 1 Where materials handling from initial storage has ceased.

Thats because Ohios sales tax law is a bit tedious and complicated.

. Exemption Certificate Forms - Ohio Department of Taxation. These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock structure a house of public worship or a. To obtain an Ohio farm tax exempt form a farmer should visit the Department of Taxations website.

There are three variants. The Ohio sales and use tax exemption for manufacturers allows businesses to purchase tangible personal property to be used or consumed in the manufacturing process free from the Ohio sales and use tax. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer.

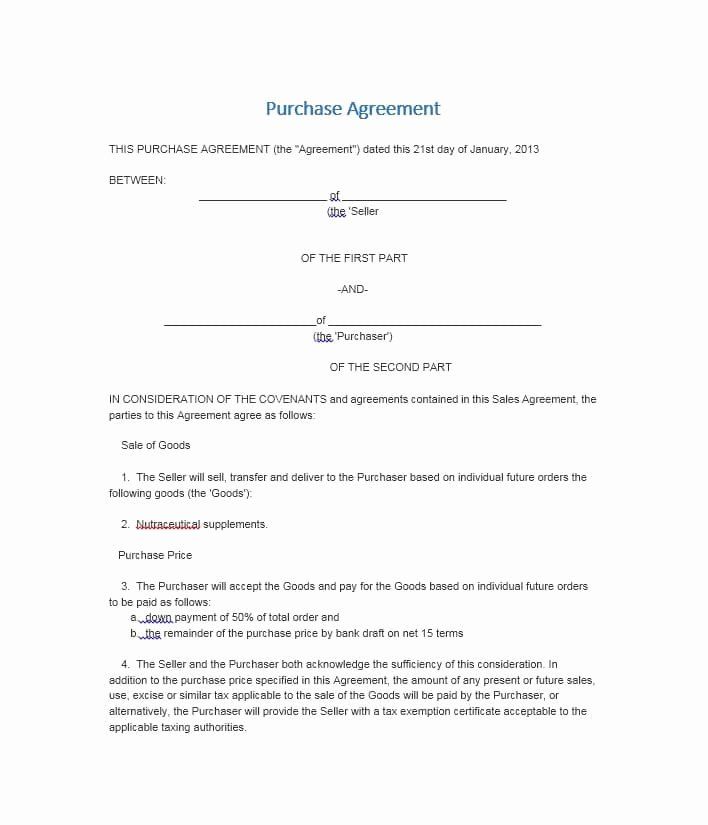

Decide on what kind of eSignature to create. To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and. He will need either a Sales and Use Tax Unit Exemption Certificate form STEC U or a.

Reasons for Tax Exemption in Ohio Sales and Use Tax. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ohio Sales Tax Exemption Resale Forms 3 PDFs.

The seller is required by law to collect sales tax and remit it to the state so a tax exemption certificate must be presented at the time of the purchase. Prior to this sales tax was paid directly to the Treasurer of State not the local Clerk of Courts title office. Ad Fill out a simple online application now and receive yours in under 5 days.

Offer helpful instructions and related details about Reasons For Tax Exemption Ohio - make it easier for users to find business information than ever. Sales tax exemption in the state applies to certain types of food some building materials and prescription drugs. Tax-exempt items and services include.

Purchasers type of business. Alternately a consumer claiming the multiple points of use claim may provide an exemptioncertificate form indicating multiple points of use as the reason for claiming exemption. This represents a significant and important savings that manufacturers shouldnt overlook.

Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. Ohio Sales Tax Exemption Resale Forms 3 PDFs. Purchaser must state a valid reason for claiming exception or exemption.

The state sales and use tax rate is 575 percent. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. OH Off-Highway Motorcycle An exemption applies to off-highway motorcycles purchased prior to July 1 1999 which is when the requirement to title these vehicles came into effect.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. Sales and Use Tax Blanket Exemption Certificate. The sales and use tax is Ohios second-largest source of revenue.

2 Where materials handling from the place of receipt ceases wo initial storage 3 Where materials have been mixed measured blended heated cleaned or otherwise treated or prepared for the manufacturing process. City state ZIP. This form is updated annually and includes the most recent changes to the tax code.

An example reason for the purposes of completing the form could read purchases used for agriculture horticulture or floriculture production. Complete Edit or Print Tax Forms Instantly. Top Rated Pest Control Companies Top Rated Pest Control Services Top 5 Restaurants In Austin Texas.

Step 2 Enter the vendors name Step 3 Describe the reason for claiming the sales tax exemption. As of August 2011 Ohio imposes a 55 percent sales and use tax on qualifying retail transactions and. Counties and regional transit authorities may levy additional sales and use taxes.

Ohio Sales Tax Exemption Form On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement. In addition to requiring purchaser information such as name address and business type Ohio Form STEC B also requires an. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

Select the document you want to sign and click Upload. Follow the step-by-step instructions below to eSign your ohio tax exempt form pdf. 1 Where materials handling from initial storage has ceased.

If purchasing merchandise for resale some wording regarding the resale of products will likely be included. Beginning of the Manufacturing Process. A typed drawn or uploaded signature.

In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Vendors name and certifi or both as shown hereon. Sales of certain items are exempt from sales and use tax.

A completed form requires the vendors name the reason claimed for the sales tax exemption and the purchasers name address signature date and vendors number if the purchaser has one. Purchaser must state a valid reason for claiming exception or exemption. Ad Access Tax Forms.

The Ohio Sales Tax Exemption Form is a helpful resource that breaks down the exemptions by category. Those are the reasons for our newest law bulletin Ohios Agricultural Sales Tax Exemption Laws. 4 Different materials can have different points of commitment.

Restaurant meals may also have a special sales. This page explains how to make tax-free purchases in Ohio and lists three Ohio sales tax exemption forms available for download. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Ohio sales tax you need the appropriate Ohio sales tax exemption certificate before you can begin making tax-free purchases.

The law has several agricultural exemptions but it can be challenging to understand who can claim them and what types of goods and services are exempt. To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket Exemption Certificate and provide a copy of this certificate to their vendorsIn addition to requiring purchaser information such as name address and business type Ohio Form STEC B also requires an explanation for why. To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket Exemption Certificate and provide a copy of this certificate to their vendors.

Resale Certificate Request Letter Template 5 Templates Example Templates Example Letter Templates Lettering Certificate Templates

2021 Residential Homestead Exemption Homesteading Harris County Real Estate Agent

Arkansas Sales Tax Exemption Form Form Tax Arkansas

Illinois Quit Claim Deed Form Quites Illinois The Deed

Ayoubhassab I Will Get You Walmart Tax Exempt In All States The Legal Way For 200 On Fiverr Com Tax Consulting Tax Walmart

Arizona Student Loan Forgiveness Programs Arizona State Of Arizona Arizona State

The Marvelous Texas Sales And Use Tax Exemption Certification Blank Form Within Resa Certificate Templates Letter Templates Certificate Of Achievement Template

Fillable Standard Form 1094 15c Standard Form Fillable Forms Tax Exemption

5 8 Woven Jacquard Butterfly Ribbon 3 Yards Etsy Butterfly Ribbon Etsy

New Form Released For Surviving Spouse Lod Homestead Property Tax Exemption Contact Your Support Coordinator Wit Property Tax Tax Exemption Homestead Property

Sample Letter Requesting Sales Tax Exemption Certificate Regarding Resale Certificate Cover Letter For Resume Teacher Resume Examples Resume Objective Examples

Application For Hospital Sales Tax Exemption Tax Exemption Illinois Sales Tax

School Odh 216a Certificate Of Exemption Https Www Ok Gov Health2 Documents Imm School Odh 216a Certificate Of Exemp Child Care Facility School Kids School

Business Sale Contract Template Luxury 37 Simple Purchase Agreement Templates Real Estate Business Contract Template Purchase Agreement Purchase Contract

Pioneer Utah State Flag Seal Student Loan Forgiveness Power Of Attorney Form Loan Forgiveness

Application For Hospital Sales Tax Exemption Tax Exemption Illinois Sales Tax